We approach portfolio design from a holistic perspective. Equities (stocks) play an important part of most investment portfolios. The advantage of the stock market is that over long periods of time it goes up, providing investors a return historically around 8-10% per year depending on the years included in the measurement. About 44% of this gain is through reinvestment of dividends, which is not always possible if the portfolio needs to generate spendable income. Sector investing and index investing using mutual funds and Exchange Traded Funds and Notes (ETFs and ETNs) has grown substantially over the last decade as some investors have sought to avoid the risks inherent in individual stock picking. While these approaches will never achieve the highest possible returns due to their group investment approach, in general they provide the benefit of lower risk through less concentration in only a few equities.

Unfortunately, this does not always hold true. Looking at the underlying causes of changes in stock prices, we find that corporate profit levels and the economy are significant drivers, as well as investor demand in the short term. In times when the economy falters and investor demand decreases, we have seen stocks across many sectors and even major market indices suffer multi-year declines. In these periods, the individual stocks making up the sectors and indices become highly correlated, accelerating this decline.

After March 2000 it took the

S&P 500 index over 13 years (April

2013) to make significant progress above the level reached at that

time. This shows the high level of correlation stocks can

exhibit, and why using only stocks in your retirement portfolio may

lead to increased risk with lower returns over time. In fact, from

January 1 2000 to March 31st 2020 (21 years, 3 months), the average

compound rate of return

of the S&P 500 index was only 2.98% per year.

After March 2000 it took the

S&P 500 index over 13 years (April

2013) to make significant progress above the level reached at that

time. This shows the high level of correlation stocks can

exhibit, and why using only stocks in your retirement portfolio may

lead to increased risk with lower returns over time. In fact, from

January 1 2000 to March 31st 2020 (21 years, 3 months), the average

compound rate of return

of the S&P 500 index was only 2.98% per year.

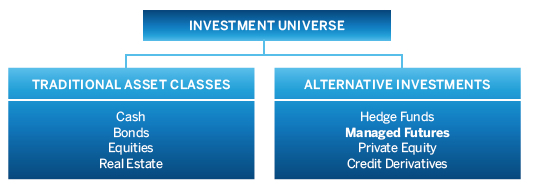

Most investors don't realize that all stock investments are part of the same asset class, possessing the same systematic/market risk. To achieve true diversification when factors negatively effect the entire stock market, portfolios may also incorporate the use of other asset classes that are not effected in the same way by these factors. In general, there are many factors that effect stocks negatively that can have a positive effect on other asset classes. An example would be inflation. Inflation tends to negatively effect stocks, while many real asset classes (commodities, real estate, some private placements) may be positively effected. This lack of correlation between diverse asset classes can be a key risk mitigator in retirement portfolios.

Our approach uses non-correlated securities investments (as much as

can be achieved) along with small percentages of other non-correlated

asset classes. The ideal situation is to have one asset class going

down while the other is going up and vice versa, while both investments

achieve positive returns over time. The goal is a smoother upward

equity curve at the Porfolio Level, versus working toward the

impossible goal of picking a basket of stocks that only gains and never

loses.

We use portfolio development tools

that allow us to combine various

investments into portfolios and measure their performance over time in

both risk and reward terms. Give our office a call and we can work with

you to construct a portfolio using this approach, custom designed for

your needs.

Trading futures and options involves substantial risk of loss and is not suitable for all investors. Past performance is not necessarily indicative of future results.