Managed futures are a highly flexible alternative investment traded on many financial and commodity markets around the world. By broadly diversifying across markets, managed futures may simultaneously profit from price changes in stock indices, treasury futures or bond futures, and currencies, as well as from diverse commodity markets having virtually no correlation to traditional asset classes such as the stock market.

Modern Portfolio Theory first developed by Harry Markowitz of the University of Chicago in 1952 dictates that a diversified portfolio of uncorrelated assets can provide maximum return for minimal volatility. Managed futures offer investors one of the most uncorrelated and independent investments relative to most other traditional asset classes. Investors should be aware that trading futures and options involves substantial risk of loss and is not suitable for all investors.

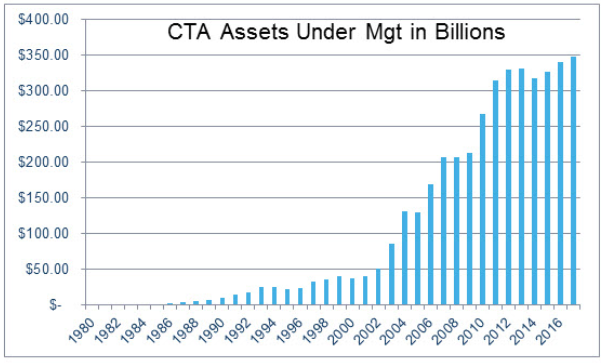

Managed Futures Growth

|

Over the past several decades, investors large

and small have embraced managed futures. The growth in assets under

management (AUM) has been impressive and AUM has recently topped $348

billion; up from virtually nothing 36 years ago. Managed futures have historically been uncorrelated with the returns in traditional asset classes such as stocks and bonds, enabling them to enhance returns as well as lower overall volatility. |

|

Benefits of Managed Futures

The benefits of managed futures within a well-balanced portfolio include:

- Potential to lower overall portfolio risk;

- Opportunity to enhance overall portfolio returns;

- Broad diversification opportunities;

- Opportunity for returns in a variety of economic environments; and

- Limited losses due to a combination of flexibility and discipline.

Managed futures are investment products in which professional money managers called Commodity Trading Advisors ("CTAs") direct investments in the futures markets utilizing futures contracts and/or options on futures. While investment management professionals have been using managed futures for more than 30 years, institutional investors such as corporate and public pension funds, endowments and banks have more recently begun to employ managed futures in pursuit of a well-diversified portfolio.

Academic research on the suitability of managed futures has been significant and supportive of the investments. For example, in a 1983 landmark study entitled "The Potential Role of Managed Futures Accounts in Portfolios of Stocks and Bonds," Dr. John Lintner of Harvard University found that "portfolios . . . including judicious investments . . . in leveraged managed futures accounts show substantially less risk at every possible level of expected return than portfolios of stocks (or stocks and bonds) alone." Be advised that this study was conducted in academia and as such, the results are not based on actual trading.

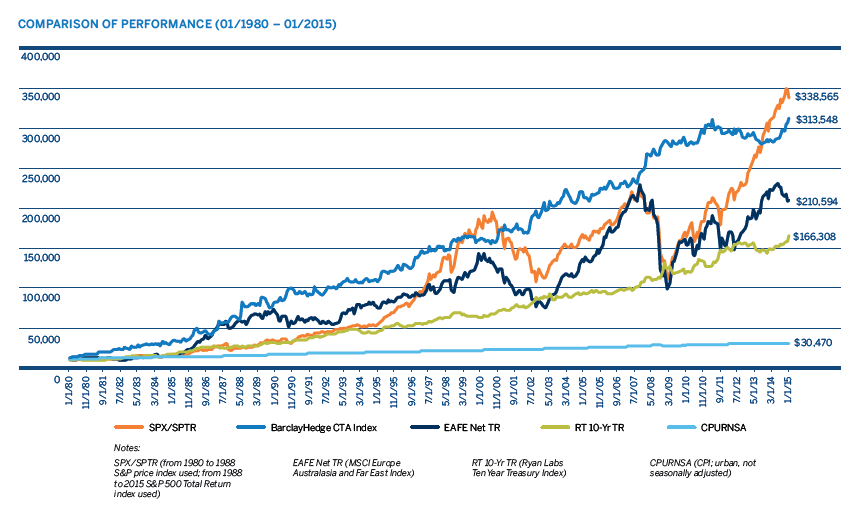

Comparison of Performance (01/1980 - 01/2015)

|

. |

The above chart compares Managed Futures represented by the

Barclay/Hedge CTA Index versus several major benchmarks.

US Stocks are represented by the S&P 500 TR Index. As

one

can see, over a 34 year period managed futures has demonstrated

comparable

performance to the S&P 500 TR Index with significantly lower

percentage declines, and has significantly outperformed the other

benchmarks shown.

Trading futures and options involves substantial risk of loss and is not suitable for all investors. Past performance is not necessarily indicative of future results. There are no guarantees of profit no matter who is managing your money.

To learn more about managed futures, please view the following documents which are property of CME Group.

- 10 Reasons to Consider Adding Managed Futures to your Portfolio

- Lintner Revisited: A Quantitative Analysis of Managed Futures Strategies

Diverse Set of Managed Programs

Global Capital Group offers clients access to a number of managed futures programs. On behalf of our clients, we spare no effort in finding Commodity Trading Advisors that we feel offer the potential for good returns while also employing good risk management strategies.

We use specific criteria when choosing recommended Commodity Trading Advisors. These Commodity Trading Advisors can be established or emerging, but in our opinion they all share a few things in common including a disciplined investment approach, a positive track record and a strong management team. When we find such Commodity Trading Advisors, we vet their processes and determine their unique benefits in portfolio construction based on markets used and strategies employed.

Be advised that there is a substantial risk of loss involved in trading futures and options. Investing in managed futures is not suitable for everyone. Though some managed futures programs have performed well historically, there is no guarantee that an individual managed futures program will continue to profit or will not suffer losses in the future.

Trading futures and options involves substantial risk of loss no matter who is managing your money. Such an investment is not suitable for everyone. Past performance is not necessarily indicative of future results.

CME Group is a trademark of CME Group Inc. The Globe logo, CME, Chicago Mercantile Exchange and Globex are trademarks of Chicago Mercantile Exchange Inc. Further information about CME Group and its products can be found at www.cmegroup.com.